What are some examples of proof of transaction? Examples of proof of transactions can be cash notes, credit notes, debit notes, invoices, receipts, checks, demand deposits, and many more. Here’s the full explanation.

Type of Proof of Transaction

There are two types of transaction evidence. Both are different from the side of the receiver and sender. However, its use and function are the same as a registered document to validate transactions.

The two types of transaction evidence are internal transaction evidence and external transaction evidence.

1. Evidence of Internal Transactions

Internal transaction evidence is a document issued by the finance or payment department to the company’s internal parties.

For example, proof of salary payment transactions given to employees or memorandum documents from leaders for certain divisions within the company.

This type usually states that the company has paid salary money, overtime incentives, and others, and the recipient has received it.

If you are going to complain at a later date, you must bring proof of the transaction...

2. Proof of External Transactions

What is proof of an external transaction? Evidence of external transactions is documented between the company and parties outside the company—for example, proof of tax payment transactions, building leases, purchase of production materials, etc.

The payment or finance department must keep duplicate external proof of purchase. Use as evidence if there are parties who complain. In addition, it becomes a complementary document in journals and financial records.

The Role of Proof of Transaction for Companies

The transaction document function is essential. Therefore, usually, companies will store documents from previous years neatly. Periodically, the company will clean up records.

The process of cleaning transaction documents cannot be arbitrary. Must go through management approval and apply to certain documents only. For example, after the transaction occurred so many years. The party carrying out the destruction must make an application and approval.

After exterminating, the next step must be making an official report. It must include reasons for destruction, file data, location and date of document destruction. For example, payment documents from the number so do so.

The purpose of this report is as evidence if essential documents for the company are no longer there due to the destruction process, not lost or misplaced.

With the minutes, the finance department will not be blamed when one day it turns out that the document is needed again.

Example of Proof of Transaction

1. Cash Note

A cash note is proof of payment issued by the seller as proof of the transaction for selling goods in cash. Cash receipts that have been paid off are then given to the buyer.

2. Credit Note

A credit note is an example of proof of a transaction for a reduction in receivables due to the return of goods, such as excess goods, damage so that goods need to be returned, and so on.

In some instances, returning goods because of damaged or defective goods also uses a credit note, in which the seller agrees to reduce the purchase price the buyer has made.

3. Debit Note

A debit note is an example of a transaction document that a buyer sends to a seller as proof of debt reduction due to a return or return of goods—adding a certain amount to an account on the debit side. For example a purchase of goods, the amount of goods on the debit side increases.

4. Invoice

An invoice is proof of a transaction containing information regarding the item’s name, quantity and price, discount (if any), tax, and a summary regarding the deadline for delivery of goods and payment.

This document, also known as an invoice, is generally issued by the seller to be submitted to the buyer.

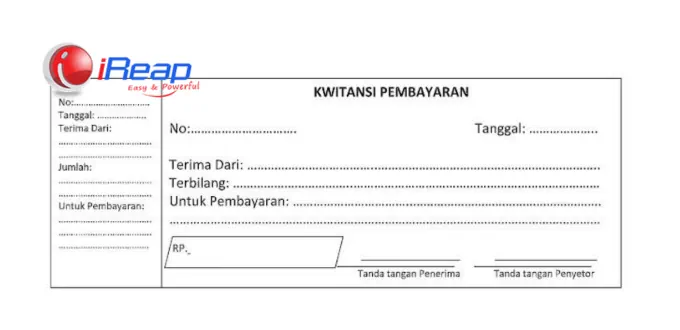

5. Receipt

A receipt is an example of proof of transaction at the time of receipt of a sum of money. The ticket is made and signed by the recipient of the capital and then handed over to the person making the payment.

6. Check

A check is a payment order made by a party with a bank account. The recipient must bring it to the bank, and then the bank pays the amount of money listed in the check.

7. Proof of Memorandum

Evidence of the memorandum also includes proof of transactions made by the company’s leadership or a person authorized for an event within the company’s internal affairs—for example, a memo for giving bonuses or rewards to outstanding employees.

8. Bilyet Giro

Bilyet Giro also includes examples of proof of transactions. The definition of a demand deposit is an order from the account owner to the bank to transfer an amount of money from the customer’s account to the recipient’s account, whose name is stated in the demand deposit.

9. Current Account

A checking account is proof of cash movements at the bank prepared by the bank for its customers.

10. Bank Deposit Proof

Proof of bank deposit is a transaction record (deposit slip) provided by the bank to be used when or every time you deposit money, such as when you want to save at the bank.

You already know the types and examples of proof of transactions. Apart from the various models of confirmation of transactions mentioned above, there are many other forms of proof of transactions. Get to know more in the following explanation: Types of Transaction Evidence.